How land taxes can help with the housing crisis

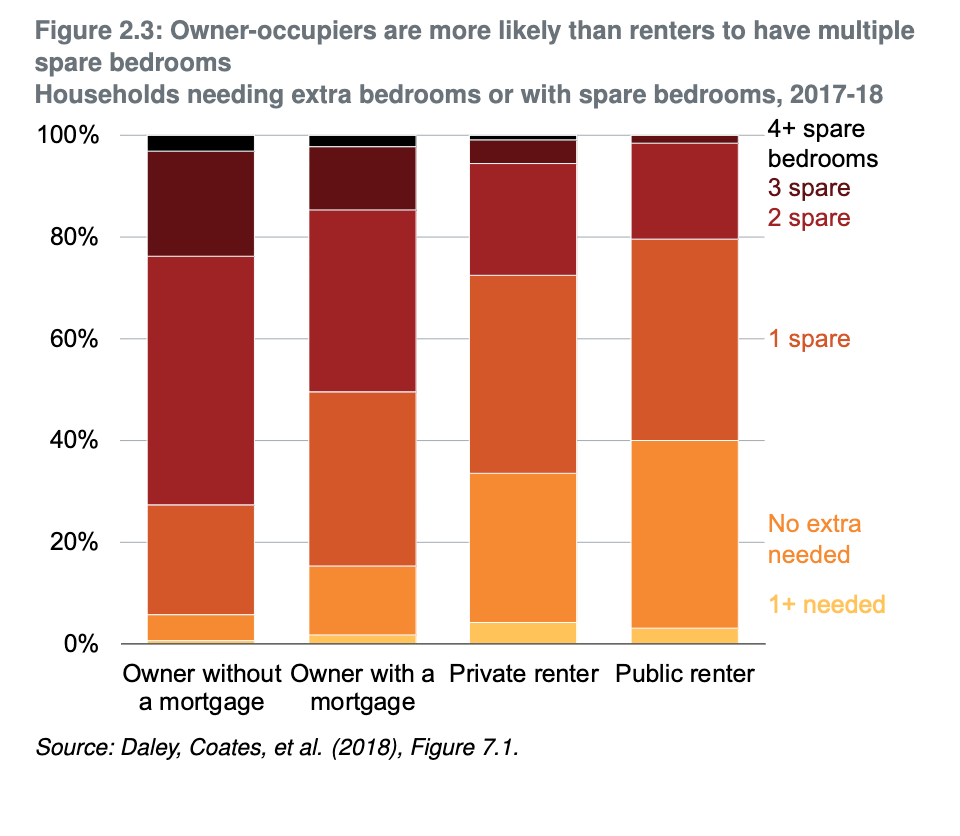

People rarely sell their homes in Australia because stamp duties make it too expensive. The misallocation of housing stock is now obvious: spare bedrooms are much more prevalent in owner-occupied dwellings – where housing moves are constrained by stamp duty – than in the private rental market, where they are not.

In contrast to stamp duties, land taxes do not distort decisions about land use, provided they apply in a way that the landowner can’t avoid. For example, a constant-rate land tax applied to the unimproved value of all land prevents landowners from reducing their liability to such a tax by changing the way they use their land. The tax on a vacant block of land would not increase even after the block was developed.

And while the political economy of land taxes is challenging - the right design can help alleviate political barriers. The best way to reduce the political salience of land-tax is to avoid sending landowners a yearly bill. That way asset-rich but income-poor households can stay in their homes, by allowing them to defer paying the levy until they sell their property. Deferral arrangements are already available for seniors paying council rates in South Australia, Western Australia, and the ACT.

A recent paper by Prosper Australia argues that deferred land tax should be available to all households, but interest on any deferment should be charged at market rates. An independent statutory body could then hold any deferred land tax liabilities, and provide revenue to government in the form of a dividend to the government every year.

The section above was adapated from Coates B, Nolan J. NSW Should Swap Stamp Duties for a Broad-Based Property Tax. Grattan Institute; 2019.

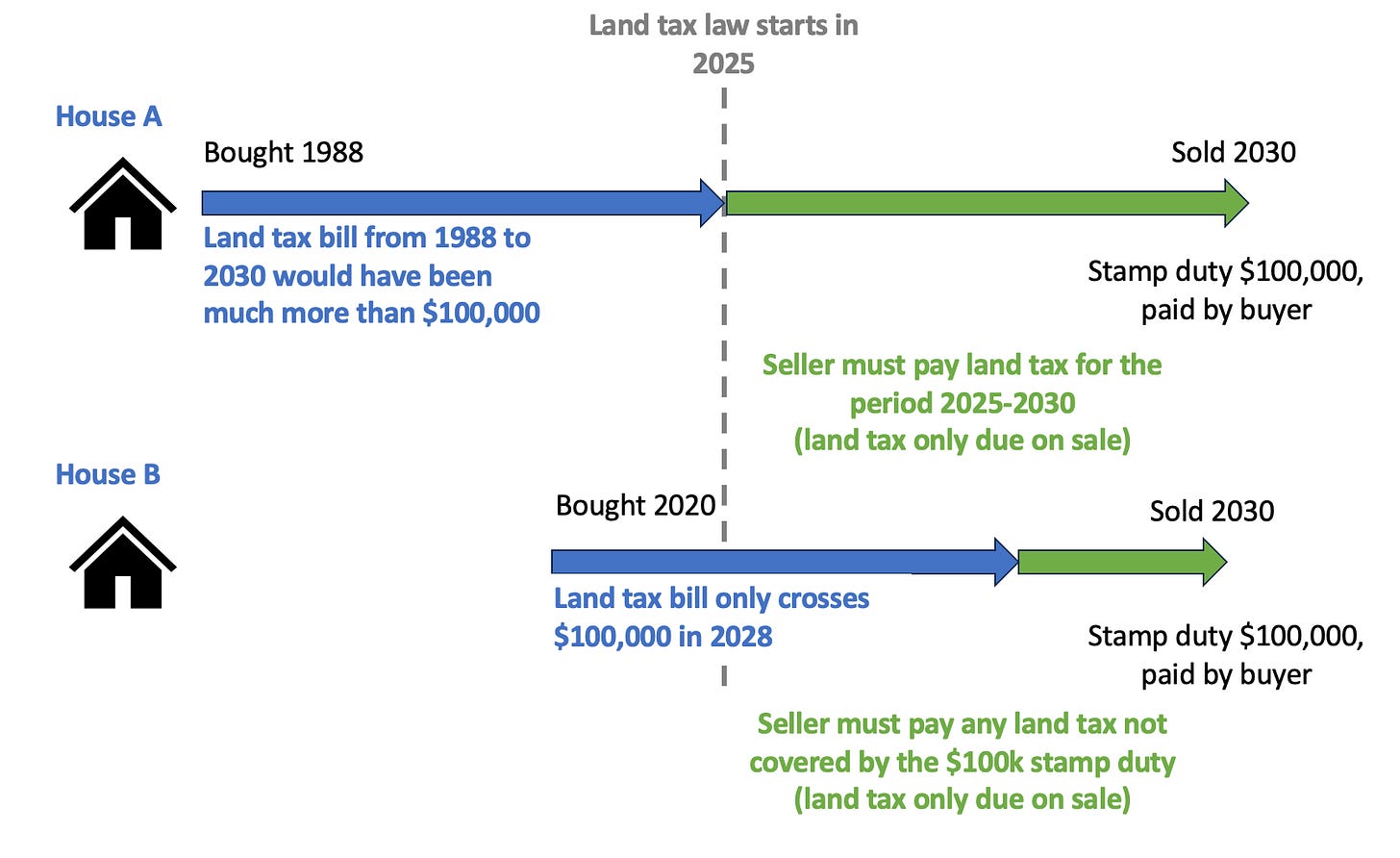

There’s a million ways a land tax could be phased in, but one I particularly like is by making it revenue positive from the beginning. Start by calculating how much land tax every homeowner would have paid had there always been a land tax. If the stamp duty system was giving them an effective ‘discount’ on their land tax bill, they should have to pay the difference on any land tax that accrues from the start date of the law. The figure below shows how it would work:

The extra revenue generated could be used to placate voters and ensure a just transition. Over time as revenues increased governments could make the decision to lower stamp duties or even lower other taxes.

Land tax ‘reforms’ are fairly criticised as a way for conservative governments to starve the beast and reducing overall tax revenue. But with this reform we could have the best of both worlds - increasing the most efficient tax while doing whatever is politically expedidient with the rest of the tax base.